OFFICE LEASE DATED DECEMBER 13, 2016 BY AND BETWEEN VISUALANT, INCORPORATED AND LOGAN BUILDING LLC.

Published on December 29, 2017

|

Exhibit

10.33

OFFICE LEASE

LOGAN BUILDING LLC

“LANDLORD”

WITH

VISUALANT INCORPORATED

“TENANT”

BUILDING: LOGAN BUILDING

SUITES: 810 and 815

DATED: December 13, 2016

|

Table Of Contents

|

|

Page

|

|

SECTION 1: BASIC PROVISIONS

|

1

|

|

|

|

|

SECTION 2: PREMISES AND PREPARATION OF PREMISES

|

2

|

|

|

|

|

SECTION 3: TERM AND COMMENCEMENT

|

2

|

|

|

|

|

SECTION 4: BASE RENT AND ADDITIONAL RENT

|

3

|

|

|

|

|

SECTION 5: QUIET ENJOYMENT

|

5

|

|

|

|

|

SECTION 6: UTILITIES AND SERVICES

|

5

|

|

|

|

|

SECTION 7: DEPOSITS

|

6

|

|

|

|

|

SECTION 8: USE, COMPLIANCE WITH LAWS AND RULES

|

7

|

|

|

|

|

SECTION 9: MAINTENANCE AND REPAIRS

|

7

|

|

|

|

|

SECTION 10: ALTERATIONS AND LIENS

|

8

|

|

|

|

|

SECTION 11: INSURANCE AND WAIVER OF SUBROGATION

|

8

|

|

|

|

|

SECTION 12: CASUALTY DAMAGE

|

9

|

|

|

|

|

SECTION 13: CONDEMNATION

|

10

|

|

|

|

|

SECTION 14: ASSIGNMENT AND SUBLETTING

|

10

|

|

|

|

|

SECTION 15: PERSONAL PROPERTY, RENT AND OTHER TAXES

|

11

|

|

|

|

|

SECTION 16: TENANT’S DEFAULT; LANDLORD’S

REMEDIES

|

12

|

|

|

|

|

SECTION 17: SUBORDINATION, ATTORNMENT AND LENDER

PROTECTION

|

13

|

|

|

|

|

SECTION 18: ESTOPPEL CERTIFICATES

|

14

|

|

|

|

|

SECTION 19: RIGHTS RESERVED BY LANDLORD

|

14

|

|

|

|

|

SECTION 20: LANDLORD’S DEFAULT; REMEDIES

|

15

|

|

|

|

|

SECTION 21: RELEASE AND INDEMNITY

|

16

|

|

|

|

|

SECTION 22: RETURN OF POSSESSION

|

16

|

|

|

|

|

SECTION 23: HOLDING OVER

|

17

|

|

|

|

|

SECTION 24: NOTICES

|

17

|

|

|

|

|

SECTION 25: REAL ESTATE BROKERS

|

17

|

|

|

|

|

SECTION 26: NO WAIVER

|

17

|

|

|

|

|

SECTION 27: SAFETY AND SECURITY DEVICES, SERVICES AND

PROGRAMS

|

18

|

|

|

|

|

SECTION 28: TELECOMMUNICATION LINES AND EQUIPMENT

|

18

|

|

|

|

|

SECTION 29: HAZARDOUS SUBSTANCES; DISRUPTIVE

ACTIVITIES

|

19

|

|

|

|

|

SECTION 30: DISABILITIES ACTS

|

19

|

|

|

|

|

SECTION 31: DEFINITIONS

|

20

|

|

|

|

|

SECTION 32: OFFER

|

21

|

|

|

|

|

SECTION 33: MISCELLANEOUS

|

21

|

|

|

|

|

SECTION 34: ENTIRE AGREEMENT

|

23

|

|

|

|

i

|

EXHIBIT A: LEGAL DESCRIPTION OF PROPERTY

|

|

|

|

|

|

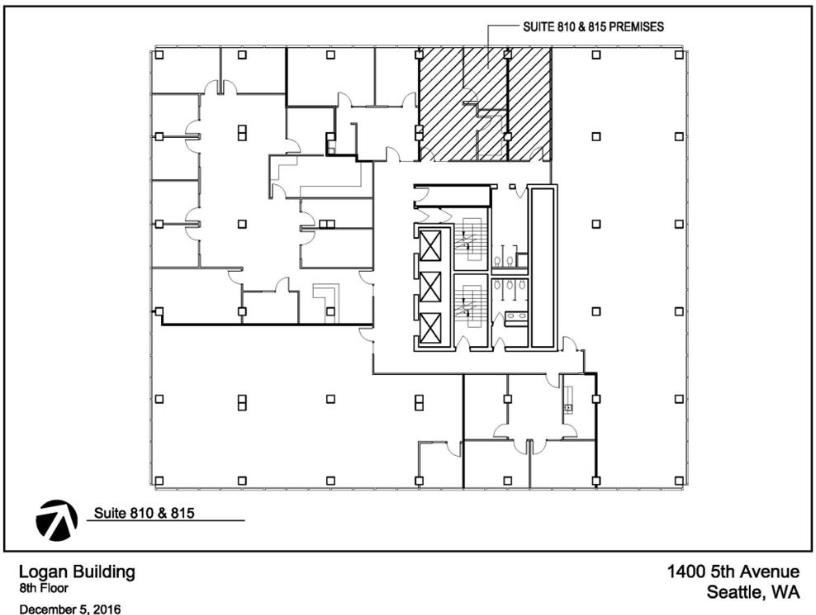

EXHIBIT B: FLOOR PLATE SHOWING PREMISES

|

|

|

|

|

|

EXHIBIT C: WORK LETTER

|

|

|

|

|

|

RIDER ONE: RULES

|

|

|

|

|

|

RIDER TWO: GREEN ADDENDUM

|

|

ii

OFFICE LEASE

THIS

OFFICE LEASE (“Lease”) is made and entered into as of

this 13th

day of December, 2016, by and between LOGAN BUILDING LLC, a

Delaware limited liability company (“Landlord”), and

VISUALANT INCORPORATED, a Nevada corporation

(“Tenant”). In consideration of this Lease, Landlord

and Tenant covenant and agree as follows:

SECTION

1: BASIC PROVISIONS

This

Section contains the basic lease provisions between Landlord and

Tenant.

A. Building:

500 Union Street,

Seattle, Washington 98101 (“Building”), located on a

portion of the real property legally described in Exhibit A

attached hereto (“Property”).

B. Premises:

Suites 810 and 815

in the Building as identified in Exhibit B.

C. Commencement Date:

January 1, 2017,

subject to Section 3.

D. Expiration Date:

January 31, 2022,

subject to Section 3.

E. Rentable Area:

The rentable area

of the Premises shall be deemed to contain 943 rentable square feet

(“RSF”), subject to Section 31(O).

F. Tenant’s

Share:

00.80%, subject to

Section 4 and Section 31(O).

G. Base Rent:

From the

Commencement Date through the Expiration Date, as further described

in Section 4, as follows:

Months 1 –

12*:

$34.00/RSF/year

($2,671.83 per month)

Months 13 –

24:

$35.00/RSF/year

($2,750.42 per month)

Months 25 –

36:

$36.00/RSF/year

($2,829.00 per month)

Months 37 –

48:

$37.00/RSF/year

($2,907.58 per month)

Months 49 –

60:

$38.00/RSF/year

($2,986.17 per month)

Month

61:

$39.00/RSF/year

($3,064.75 per month)

*Tenant

shall be entitled to an abatement of Base Rent in the amount of

$2,671.83, which amount shall be credited against Base Rent for the

first calendar month of the Term.

H. Additional Rent:

Tenant shall pay

Tenant’s Share of Taxes and Tenant’s Share of Expenses

in excess of such amounts for the period September 1, 2016 –

August 31, 2017 (“Base Year”) as further described in

Section 4.

I. Permitted Use:

Executive and

administrative office use, subject to Section 8.

J. Deposits:

$5,070.00, which

Landlord already holds and will not be increased, and shall be

subject to Section 7.

K. Parking:

Tenants at the

Logan Building may arrange for parking spaces at the neighboring US

Bank Center garage (“Garage”), subject to availability

of parking spaces within the Garage and payment of the

Garage’s then applicable monthly rate.

L. Broker (if any):

Scott Driver of

Scott Driver & Co., P.S., as Tenant's broker

Oscar

Oliveira, Damon McCartney and David Marks of Broderick Group, Inc.,

as Landlord's broker

M. Guarantor(s):

N/A.

N. Riders/Exhibits:

Exhibit A

(Property)

Exhibit

B (Premises)

Exhibit

C (Work Letter)

Rider

One (Rules)

Rider

Two (Green Addendum)

O. Landlord’s Notice Address (subject to

Section 24):

Logan

Building LLC

c/o

Unico Properties LLC

Attn:

Senior Vice President / CFO

1215

Fourth Avenue, Suite 600

Seattle, WA

98161

1

With a

copy to:

Logan

Building LLC

c/o

Unico Properties LLC

Attn:

Logan Building Property Manager

1215

Fourth Avenue, Suite 600

Seattle, WA

98161

P. Tenant’s Notice Address (subject to

Section 24):

Visualant

Incorporated

Attn:

Office Manager

The

Logan Building

500

Union Street, Suite 810

Seattle, WA

98101

Q. Rent Payments:

Rent shall be paid

to the following, or to such other parties and addresses as to

which Landlord shall provide advance notice:

Logan

Building LLC

c/o

Unico Properties LLC

Attn:

Accounts Receivable

1215

Fourth Avenue, Suite 600

Seattle, WA

98161

The

foregoing provisions shall be interpreted and applied in accordance

with the other provisions of this Lease. The terms of this Section,

and the terms defined in Section 31 and other Sections, shall

have the meanings specified therefor when used as capitalized terms

in other provisions of this Lease or related documentation (except

as expressly provided to the contrary therein).

SECTION

2: PREMISES AND PREPARATION OF PREMISES

A. Premises.

Landlord hereby leases to Tenant and Tenant hereby leases from

Landlord the Premises subject to the provisions herein contained.

Tenant agrees to accept the Premises “as is” without

any agreements, representations, understandings or obligations on

the part of Landlord to construct any improvements within the

Premises other than the Tenant Improvements, if any, described in

Exhibit C, or to perform any repairs or maintenance to the Premises

or Building except as expressly provided under this Lease. Tenant

further acknowledges that, except as otherwise expressly stated in

this Lease, Landlord has not made any representation or warranty

(express or implied) with respect to the habitability, condition or

suitability of the Premises, Building or Property for

Tenant’s purposes or any particular purpose.

B. Preparation

of Premises. The obligations of Landlord and Tenant to

perform work and supply materials and labor to prepare the Premises

for Tenant’s occupancy shall be as set forth in

Exhibit C attached hereto and incorporated herein.

Landlord’s obligation, if any, for completion of the Premises

(“Landlord’s Work”) shall be defined and limited

by said Exhibit C, and Landlord shall not be required to furnish or

install any item not indicated thereon. Any additional alterations

or improvements to the Premises beyond those set forth on Exhibit C

shall be at Tenant’s sole cost and expense and subject to all

provisions of Section 10, including without limitation the prior

approval of Landlord. Taking possession of the Premises by Tenant

shall be conclusive evidence the Premises were, on that date, in

good, clean and tenantable condition and delivered in accordance

with this Lease, unless set forth otherwise in a mutually agreed

upon written “punch list.”

C. Governing

Property Documents. The Property is subject to and governed

by that First Amended and Restated Pacific First Center/Logan

Building Agreement recorded under King County Recording No.

8704210116, as amended by any other amendments thereto hereafter

adopted (collectively, “Governing Property Documents”).

Tenant’s use of the Premises, Property and Common Areas, and

rights and interest in this Lease, all are subject to the Governing

Property Documents, and Tenant shall be responsible for complying

with those requirements in the Governing Property Documents

applicable to Tenant’s use of the Premises. Additions and

modifications to Governing Property Documents shall be binding on

Tenant upon delivery of a copy of them to Tenant.

SECTION

3: TERM AND COMMENCEMENT

A. Term

and Confirmation. The term (“Term”) of this

Lease shall commence on the Commencement Date and end on the

Expiration Date as specified in Section 1 above, unless sooner

terminated as provided herein, subject to adjustment as provided

below and the other provisions hereof. If the Commencement Date is

advanced or postponed as provided below, the Expiration Date set

forth in Section 1 shall not be changed, unless Landlord so elects

by notice to Tenant. Tenant shall execute a confirmation of the

Commencement Date and other matters in such form as Landlord may

reasonably request within ten (10) days after requested (but

nothing herein shall require Landlord to so request); any failure

to respond within such time shall be deemed an acceptance of the

matters as set forth in Landlord’s confirmation. If Tenant

disagrees with Landlord’s adjustment of the Commencement

Date, Tenant shall pay Rent and perform all other obligations

commencing on the date determined by Landlord, subject to refund or

credit when the matter is resolved.

2

B. Adjustments

to Commencement Date. The parties acknowledge that the

Commencement Date specified in Section 1 is an estimated date. This

Lease shall commence on the Commencement Date specified in Section

1 if Landlord’s Work is Substantially Complete (as that term

is defined in Exhibit C) by such date but otherwise the

Commencement Date shall be adjusted to be the first to occur of the

following events: (i) the date Landlord provides Tenant notice that

Landlord’s Work is Substantially Complete; (ii) the date on

which Tenant takes possession or commences beneficial occupancy of

the Premises; or (iii) if Substantial Completion of

Landlord’s Work is delayed in whole or in part due to Tenant

Delay (as that term is defined in Exhibit C), then the date

determined by Landlord as the date upon which Landlord’s Work

would have been Substantially Complete, but for Tenant’s acts

or omissions. In no event shall Landlord have any liability for

loss or damage to Tenant resulting in any delay in the Commencement

Date, nor shall Tenant have any right to terminate this Lease, and

Tenant’s sole recourse shall be the postponement of Rent and

other obligations until the Commencement Date is established as set

forth above.

C. Early

Access. If Landlord’s Work is Substantially Complete

prior to the Commencement Date specified in Section 1, upon

reasonable notice from Tenant to Landlord, Tenant shall be entitled

to enter the Premises for fixturing and move in purposes provided

(i) Tenant shall not interfere with Landlord’s completion of

Landlord’s Work and shall coordinate its activities and

comply with Landlord’s directives, (ii) all provisions

of this Lease other than those relating to payment of Rent shall

apply to any such pre-commencement entry (including without

limitation all insurance, indemnity and freedom from lien

provisions), and (iii) Tenant shall not beneficially occupy the

Premises (or any part thereof) or commence business operations from

the Premises (or any part thereof) during such period.

SECTION

4: BASE RENT AND ADDITIONAL RENT

A. Base

Rent. Subject to adjustment for expenses, taxes and required

capital expenditures as set forth in this Section 4, Tenant shall

pay Landlord the monthly Base Rent set forth in Section 1 in

advance on or before the first day of each calendar month during

the Term. The Base Rent for any fractional month occurring prior to

the Rent Abatement Period and for the first full month of the Lease

Term which occurs after the expiration of the Rent Abatement Period

shall be paid by Tenant at the time of Tenant’s execution of

this Lease.

B. Taxes

and Expenses. Tenant shall pay Landlord

“Tenant’s Share of Taxes” and

“Tenant’s Share of Expenses” in the manner

described below. All such charges shall be deemed to constitute

“Additional Rent” which shall be deemed to accrue

uniformly during the calendar year in which the payment is

due.

(i) During each

calendar year after the Base Year identified in Section 1(H) above,

Tenant agrees to pay as “Additional Rent” for the

Premises, “Tenant’s Share” (defined below) of all

increases in Taxes and Expenses incurred by Landlord in the

operation of the Building and Property, over the amount of the

Property Taxes and Expenses incurred by Landlord in the operation

of the Building and Property during the Base Year. For purposes of

this Lease, “Tenant’s Share” shall mean the ratio

between the rentable area of the Premises and the rentable area of

the Building. Tenant’s Share, calculated based on the initial

square foot area of the Premises, is set forth in Section 1(F)

above, and is subject to adjustment as set forth in Section

31(O).

(ii) Prior

to or promptly after the commencement of each calendar year

following the Base Year, Landlord shall give Tenant a written

estimate of the anticipated increases in Taxes and Expenses over

the Base Year and Tenant’s Share of such increases. Tenant

shall pay such estimated amount to Landlord in equal monthly

installments, in advance, without deduction or offset, on or before

the first day of each calendar month, with the monthly installment

of Base Rent payable in accordance with Section 4(A) above. After

the end of each calendar year, Landlord shall furnish to Tenant a

statement showing in reasonable detail the actual increases over

the Base Year in the Taxes and Expenses incurred by Landlord during

the applicable calendar year and Tenant’s Share thereof. If

the statement shows Tenant’s Share of the actual increases

exceeds the amount of Tenant’s estimated payments, within

thirty (30) days after receiving the statement, Tenant shall pay

the amount of the deficiency to Landlord. If the statement shows

Tenant has overpaid, the amount of the excess shall be credited

against installments next coming due under this Section 4;

provided, however upon the expiration or earlier termination of the

Lease Term, if Tenant is not then in default under this Lease,

Landlord shall refund the excess to Tenant.

(iii) If

at any time during any calendar year of the Lease Term (other than

the Base Year) the Taxes applicable to the Building and Property

change and/or any information used by Landlord to calculate the

estimated Expenses changes, Tenant’s estimated share of such

Taxes and/or Expenses, as applicable, may be adjusted accordingly

effective as of the month in which such changes become effective,

by written notice from Landlord to Tenant of the amount or

estimated amount of the change, the month in which effective, and

Tenant’s Share thereof. Tenant shall pay such increase to

Landlord as a part of Tenant’s monthly payments of estimated

Taxes or Expenses as provided above, commencing with the month

following the month in which Tenant is notified of the

adjustment.

3

(iv) For

purposes of this Lease, the term “Expenses” means all

costs of and expenses paid or incurred by Landlord for maintaining,

operating, repairing, replacing and administering the Building and

Property, including all Common Areas and facilities and Systems and

Equipment, and shall include the following costs by way of

illustration but not limitation: water and sewer charges; insurance

premiums; license, permit, and inspection fees; heat; light; power;

steam; janitorial and security services; labor; salaries; air

conditioning; landscaping; maintenance and repair of driveways and

surface areas; supplies; materials; equipment; tools; the cost of

capital replacements (as opposed to capital improvements); the cost

of any capital improvements or modifications made to the Building

by Landlord that are intended to reduce Expenses, are required

under any Laws not applicable to the Building or Property or not in

effect at the time the Building was constructed, or are made for

the general benefit and convenience of all tenants of the Building;

all property management costs, including office rent for any

property management office and professional property management

fees; legal and accounting expenses; and all other expenses or

charges which, in accordance with industry standard accounting and

management practices, would be considered an expense of

maintaining, operating, repairing, replacing or administering the

Building or Property. Capital costs included in Expenses shall be

amortized over such reasonable period as Landlord shall determine

with a return on capital at the current market rate per annum on

the unamortized balance or at such higher rate as may have been

paid by Landlord on funds borrowed for the purpose of constructing

such capital replacements or improvements.

(v) For purposes of

this Lease, the term “Taxes” means all real estate

taxes or personal property taxes and other taxes, surcharges and

assessments, unforeseen as well as foreseen, which are levied with

respect to the Building and Property and any improvements, fixtures

and equipment and other property of Landlord, real or personal,

located in the Building or on the Property and used in connection

with the operation of the Building or Property and any tax,

surcharge or assessment which shall be levied in addition to or in

lieu of real estate or personal property taxes, other than taxes

covered in Section 15. The term “Taxes” shall also

include any rental, excise, sales, transaction, privilege, or other

tax or levy, however denominated, imposed upon or measured by the

rental reserved hereunder or on Landlord’s business of

leasing the Premises, excepting only net income, inheritance, gift

and franchise taxes.

(vi) Notwithstanding

anything to the contrary contained above, as to each specific

category of expense which one or more tenants of the Building, at

Landlord’s sole discretion, either pays directly to third

parties or specifically reimburses to Landlord (e.g., separately

metered utilities, separately contracted janitorial service,

property taxes directly reimbursed to Landlord, etc.) such

tenant(s) payments with respect thereto shall not be included in

Expenses for purposes of this Section 4, but Tenant’s Share

of each of such category of expense shall be adjusted by excluding

from the denominator thereof the rentable area of all such tenants

paying such category of expense directly to third parties or

reimbursing the same directly to Landlord. Tenant shall not enter

into separate contracts to provide any specific utility or service

normally provided by the Building, without Landlord’s prior

written consent in Landlord’s sole discretion. Moreover, if

Tenant pays or directly reimburses Landlord for any such category

of expense (which shall only be Landlord’s prior consent),

such category of expense shall be excluded from the determination

of Expenses for Tenant to the extent such expense was incurred with

respect to space in the Building actually leased to or occupied by

other Tenants.

(vii) Notwithstanding

anything to the contrary contained above, Landlord shall have the

right, from time to time, to equitably allocate some or all of the

Expenses among different portions or occupants of the Building

(“Cost Pools”), in good faith and in its reasonable

discretion. Such Cost Pools may include, but shall not be limited

to, the office space tenants of the Building, and the retail space

tenants of the Building. The Expenses within each such Cost Pool

shall be allocated and charged to the tenants within such Cost Pool

reasonably, in good faith and in an equitable manner.

(viii) If

the average occupancy of the Building is less than ninety-five

percent (95%) during any calendar year, Landlord will, in

accordance with industry standard accounting and management

practices, determine the amount of variable Taxes and Expenses

(i.e. those items which vary according to occupancy levels) that

would have been paid had the Property been ninety-five percent

(95%) occupied, and the amount so determined shall be deemed to

have been the amount of Taxes and Expenses for such

year.

C. Prorations.

If the Term commences on a day other than the first day of a

calendar month or ends on a day other than the last day of a

calendar month, the Base Rent and any other amounts payable on a

monthly basis shall be prorated on a per diem basis for such

partial calendar months. If the Base Rent is scheduled to increase

under Section 1 other than on the first day of a calendar month,

the amount for such month shall be prorated on a per diem basis to

reflect the number of days of such month at the then current and

increased rates, respectively. If the Term commences other than on

January 1, or ends other than on December 31, Tenant’s

obligations to pay amounts under this Section 4 towards Taxes and

Expenses for such first or final calendar years shall be prorated

on a per diem basis to reflect the portion of such years included

in the Term.

D. Payments

After Lease Term Ends. Tenant’s obligations to pay its

share of Taxes and Expenses (or any other amounts) as provided in

this Lease accruing during, or relating to, the period prior to

expiration or earlier termination of this Lease, shall survive such

expiration or termination. Landlord may reasonably estimate all or

any of such obligations within a reasonable time before, or anytime

after, such expiration or termination. Tenant shall pay the full

amount of such estimate, and any additional amount due after the

actual amounts are determined, in each case within ten (10) days

after Landlord sends a statement therefor. If the actual amount is

less than the amount Tenant pays as an estimate, Landlord shall

refund the difference within thirty (30) days after such

determination is made.

4

E. Landlord’s

Accounting Practices and Records. Unless Tenant takes

exception by notice to Landlord within thirty (30) days after

Landlord provides any statement to Tenant for any item of

Additional Rent, such statement shall be considered final and

binding on Tenant (except as to additional Expenses or Taxes not

then known or omitted by error). If Tenant takes exception by

notice within such time, Landlord may seek confirmation from

Landlord’s independent certified public accountant as to the

proper amount of Taxes and Expenses determined in accordance with

sound accounting practices. In such case: (i) such confirmation

shall be considered final and binding on both parties (except as to

additional expenses or taxes not then known or omitted by error),

and (ii) Tenant shall pay Landlord for the cost of such

confirmation, unless it shows that Taxes and Expenses were

overstated by at least five percent (5%). Pending resolution of any

such exceptions, Tenant shall pay all amounts shown on such

Landlord’s statement, subject to credit, refund or additional

payment after any such exceptions are resolved.

F. General

Payment Matters. Base Rent, Additional Rent which includes

without limitation Tenant’s Share of Taxes, Tenant’s

Share of Expenses and any other amounts which Tenant is or becomes

obligated to pay Landlord under this Lease or other agreement

entered in connection herewith, are sometimes herein referred to

collectively as “Rent,” and all remedies applicable to

the nonpayment of Rent shall be applicable thereto. Rent shall be

paid in good funds and legal tender of the United States of America

without prior demand, deduction, recoupment, set-off or

counterclaim, and without relief from any valuation or appraisement

Laws. Rent obligations hereunder are independent covenants. In

addition to all other Landlord remedies (i) any Rent not paid by

Tenant when due shall accrue interest from the due date at the

Default Rate until payment is received by Landlord and (ii) in

addition to such interest, Tenant shall pay Landlord a service

charge of two hundred fifty dollars ($250.00) or five percent (5%)

of the delinquent amount, whichever is greater, if any portion of

Rent is not received within five (5) business days after the due

date. No delay by Landlord in providing any Rent statement to

Tenant shall be deemed a default by Landlord or a waiver of

Landlord’s right to require payment of Tenant’s

obligations hereunder including those for actual or estimated

taxes, expenses or capital expenditures. In no event shall a

decrease in Taxes or Expenses, below their respective Base Year

levels, ever decrease the monthly Base Rent or give rise to a

credit in favor of Tenant. Landlord may apply payments received

from Tenant to any obligations of Tenant then accrued, without

regard to such obligations as may be designated by

Tenant.

SECTION

5: QUIET ENJOYMENT

Landlord agrees

that if Tenant timely pays the Rent and performs the terms and

provisions hereunder, Tenant shall hold the Premises during the

Term, free of lawful claims by any party acting by or through

Landlord, subject to all other terms and provisions of this

Lease.

SECTION

6: UTILITIES AND SERVICES

A. Standard

Landlord Utilities and Services. Provided Tenant is not in

default of this Lease, Landlord shall provide Tenant the following

utilities and services:

(i) Elevator service

during Normal Business Hours and the service of at least one

elevator during all other hours.

(ii) Heating

and cooling to maintain a temperature condition which in

Landlord’s judgment provides for comfortable occupancy of the

Premises under normal business operations during Normal Business

Hours, but not Saturdays, Sundays or those legal holidays generally

observed in the State of Washington, provided Tenant complies with

Landlord’s instructions regarding use of window coverings and

thermostats and Tenant does not utilize heat generating machines or

equipment which affect the temperature otherwise maintained by the

air cooling system. Upon request Landlord shall make available at

Tenant’s expense after-hours heat or air cooling. The minimum

use of after-hours heat or air cooling and the cost thereof shall

be determined by Landlord and confirmed in writing to Tenant, as

the same may change from time to time.

(iii) Water

for drinking, lavatory, and toilet purposes.

(iv) Electricity

for building-standard overhead office lighting fixtures, and

equipment and accessories customary for offices (up to 280 hours

per month), where: (a) the connected electrical load of all of the

same does not exceed an average of 4 watts per usable square foot

of the Premises (or such lesser amount as may be available, based

on the safe and lawful capacity of the electrical circuit(s) and

facilities serving the Premises), (b) the electricity is at nominal

120 volts, single phase (or 110 volts, depending on available

service in the Building), and (c) the systems and equipment are

suitable, the safe and lawful capacity thereof is not exceeded, and

sufficient capacity remains at all times for other existing and

future tenants, as determined in Landlord’s reasonable

discretion.

(v) Janitorial service.

Janitorial service as customary for comparable buildings within the

market which includes vacuum cleaning of carpets and cleaning of

Building standard vinyl composition tile, but no other services

with respect to carpets or nonstandard floor

coverings.

5

(vi) Maintain

the windows, doors, floors and walls (exclusive of coverings),

ceilings, plumbing and plumbing fixtures, and electrical

distribution system and lighting fixtures in good condition and

repair, except for damage caused by Tenant, its employees, agents,

invitees or visitors, except that such service will not be provided

as to any of the foregoing items that are not standard for the

Building.

(vii) Replacement

of burned out fluorescent lamps in light fixtures which are

standard for the Building. Burned out lamps or other light sources

in fixtures which are not standard for the Building will be

replaced by Landlord at Tenant’s expense.

B. Interruptions.

Landlord shall use reasonable diligence to remedy an interruption

in the furnishing of such services and utilities. If, however, any

governmental authority imposes regulations, controls or other

restrictions upon Landlord or the Building which would require a

change in the services provided by Landlord under this Lease,

Landlord may comply with such regulations, controls or other

restrictions, including without limitation, curtailment, rationing

or restrictions on the use of electricity or any other form of

energy serving the Premises. Tenant will cooperate and do such

things as are reasonably necessary to enable Landlord to comply

with such regulations, controls or other restrictions.

C. Non-Standard

Usage. Whenever heat generating machines or equipment or

lighting other than building standard lights are used in the

Premises by Tenant which affect the temperature otherwise

maintained by the air cooling system, Landlord shall have the right

to install supplementary air cooling units in the Premises, and the

cost thereof, including the cost of installation and the cost of

operation and maintenance thereof, shall be paid by Tenant to

Landlord upon billing by Landlord. Landlord may impose a reasonable

charge for utilities and services, including without limitation,

air cooling, electric current and water, required to be provided

the Premises by reason of (a) any substantial recurrent use of the

Premises at any time other than during Normal Business Hours (b)

any use beyond what Landlord agrees to furnish as described above,

(c) electricity used by equipment designated by Landlord as high

power usage equipment or (d) the installation, maintenance, repair,

replacement or operation of supplementary air cooling equipment,

additional electrical systems or other equipment required by reason

of special electrical, heating, cooling or ventilating requirements

of equipment used by Tenant at the Premises. High power usage

equipment includes without limitation, data processing machines,

punch card machines, computers and machines which operate on

220-volt circuits. Tenant shall not install or operate high power

usage equipment on the Premises without Landlord’s prior

written consent, which may be refused unless (i) Tenant confirms in

writing its obligation to pay the additional charges necessitated

by such equipment and such equipment does not adversely affect

operation of the Building, and (ii) the Building electrical

capacity to the floor(s) containing the Premises will not be

exceeded. At Landlord’s option, separate meters for such

utilities and services may be installed for the Premises and Tenant

upon demand therefor, shall immediately pay Landlord for the

installation, maintenance, repair and replacement of such

meters.

D. Limitation.

Landlord does not warrant that any of the services and utilities

referred to in this Section 6 will be free from interruption.

Interruption of services and utilities shall not be deemed an

eviction or disturbance of Tenant’s use and possession of the

Premises or any part thereof or render Landlord liable to Tenant

for damages or loss of any kind, or relieve Tenant from performance

of Tenant’s obligations under this Lease.

E. Utility

Providers. Notwithstanding anything to the contrary in this

Lease, Landlord shall have the sole, exclusive and absolute right

to determine, select and contract with utility company or companies

that will provide electricity and other basic utility service to

the Building, Property and Premises. If permitted by Law, during

the Term of this Lease, Landlord shall have the right at any time,

and from time to time, to either contract for services from a

different company or companies providing electricity or other basic

utility service (each such company hereinafter an “Alternate

Service Provider”) or continue to contract for service from

the service provider(s) that is providing such utility service to

the Building, Property or Premises at the Commencement Date (each

the “Existing Service Provider”). Tenant shall

cooperate with Landlord, the Existing Service Provider and any

Alternate Service Provider at all times and, as reasonably

necessary, shall allow Landlord, the Existing Service Provider and

any Alternate Service Provider access to the Building’s

utility lines, plumbing, feeders, risers, wiring, and any other

machinery or utility access ways within the Premises.

SECTION

7: DEPOSITS

A. Security

Deposit. Upon execution of this Lease, Tenant shall deposit

a security deposit in the amount set forth in Section 1 with

Landlord. If Tenant is in default, Landlord can use the security

deposit or any portion of it to cure the default or to compensate

Landlord for any damages sustained by Landlord resulting from

Tenant’s default. Upon demand, Tenant shall immediately pay

to Landlord a sum equal to the portion of the security deposit

expended or applied by Landlord to restore the security deposit to

its full amount. In no event will Tenant have the right to apply

any part of the security deposit to any Rent or other sums due

under this Lease. If Tenant is not in default at the expiration or

termination of this Lease, Landlord shall return the security

deposit to Tenant. Landlord’s obligations with respect to the

deposit are those of a debtor and not of a trustee, and Landlord

can commingle the security deposit with Landlord’s general

funds. Landlord shall not be required to pay Tenant interest on the

deposit. Landlord shall be entitled to immediately endorse and cash

Tenant’s prepaid deposit; however, such endorsement and

cashing shall not constitute Landlord’s acceptance of this

Lease. In the event Landlord does not accept this Lease, Landlord

shall return said prepaid deposit. In addition, Tenant hereby

grants to Landlord a security interest in all of Tenant’s

tangible personal property and fixtures located at the Premises,

and in all of Tenant’s intangible property used in regard to,

or arising from, business conducted at or from the Premises,

including but not limited to all equipment, inventory, accounts,

furniture, trade fixtures, instruments, general intangibles and all

other rights to payment, and the proceeds and products therefrom,

and all after acquired property. This Security Agreement and this

grant of a security interest is given to secure Tenant’s

performance and payment of all Rent and all other obligations of

Tenant to Landlord under this Lease. Tenant hereby appoints

Landlord as its attorney-in-fact for the limited purpose of

preparing, executing and filing on Tenant’s behalf all

appropriate UCC financing statements Landlord deems reasonably

necessary to perfect the security interest granted Landlord

hereunder, all without further notice to Tenant.

6

SECTION

8: USE, COMPLIANCE WITH LAWS AND RULES

A. Use

of Premises and Compliance With Laws. Tenant shall use the

Premises solely for the purposes set forth in Section 1 and for no

other purpose without obtaining the prior written consent of

Landlord, which shall not be unreasonably withheld for uses

consistent with Landlord’s then existing use criteria for the

Building. Tenant acknowledges that neither Landlord nor any agent

of Landlord has made any representation or warranty with respect to

the Premises or with respect to the suitability of the Premises or

the Building for the conduct of Tenant’s business, nor has

Landlord agreed to undertake any modification, alteration or

improvement to the Premises or the Building, except as provided in

writing in this Lease. Tenant acknowledges that Landlord may from

time to time, at its sole discretion, make such modifications,

alterations, repairs, deletions or improvements to the Building or

Property as Landlord may deem necessary or desirable, without

compensation or notice to Tenant, provided that such alterations,

repairs, deletions or improvements shall not materially adversely

affect Tenant’s use of the Premises during Normal Business

Hours and in no event shall Landlord be liable for any

consequential damages. Tenant shall promptly comply with all Laws

affecting the Premises and the Building, as well as the Rules

(defined below), and to any reasonable modifications to the Rules

as Landlord may adopt from time to time. Tenant acknowledges that,

except for Landlord’s obligations pursuant to Sections 9 and

30, Tenant is solely responsible for ensuring that the Premises

comply with any and all Laws applicable to Tenant’s use of

and conduct of business on the Premises, and that Tenant is solely

responsible for any alterations or improvements that may be

required by such Laws, now existing or hereafter adopted. Tenant

shall not do or permit anything to be done in or about the Premises

or bring or keep anything in the Premises that will in any way

increase the premiums paid by Landlord on its insurance related to

the Building or which will in any way increase the premiums for

fire or casualty insurance carried by other tenants in the

Building. Tenant will not perform any act or carry on any practices

that may injure the Premises or the Building that may be a nuisance

or menace to other tenants in the Building or that shall in any way

interfere with the quiet enjoyment of such other tenants. Tenant

shall not do anything on the Premises which will overload any

existing parking or service to the Premises.

B. Rules.

Tenant shall comply with the Rules set forth in Rider One attached

hereto (the “Rules”) in addition to all other terms of

this Lease. Landlord shall have the right, by notice to Tenant or

by posting at the Building, to reasonably amend such Rules and

supplement the same with other reasonable Rules relating to the

Building or Property, or the promotion of safety, care, efficiency,

cleanliness or good order therein. Nothing herein shall be

construed to give Tenant or any other Person any claim, demand or

cause of action against Landlord arising out of the violation of

such Rules by any other tenant or visitor of the Building or

Property, or out of the enforcement, modification or waiver of the

Rules by Landlord in any particular instance.

SECTION

9: MAINTENANCE AND REPAIRS

Unless

expressly provided otherwise in this Lease, and in addition to the

provisions of Section 6(A)(vi), Landlord shall maintain, in good

condition, the Common Areas of the Building, the structural parts

of the Building which shall include only the foundations, bearing

and exterior walls, subflooring, gutters, downspouts, and the roof

of the Building and the Building Systems and Equipment; provided,

in the event any such replacements, repairs or maintenance are

caused by or result from Tenant’s excessive or improper use

or occupation thereof or which are caused by or result from the

negligence or improper conduct of Tenant, its agents, employees or

invitees, the cost of such repairs shall be paid solely by Tenant

and Tenant shall pay the cost thereof within ten (10) days of

notice from Landlord. Except as provided above, and subject to

Section 10 of this Lease, Tenant shall maintain and repair the

Premises in neat, clean, sanitary and good condition, including,

without limitation, maintaining and repairing all walls,

storefronts, ceilings, interior and exterior doors, exterior and

interior windows and fixtures, Premises’ specific systems and

equipment, and interior plumbing serving the Premises as well as

any damage to the Building, Property or Premises caused by Tenant,

its agents, employees or invitees. If Tenant shall fail to keep and

preserve the Premises in said condition and state or repair,

Landlord may, at its option (but with no obligation) put or cause

the same to be put into the condition and state of repair agreed

upon, and in such case Tenant, on demand, shall pay the cost

thereof.

7

SECTION

10: ALTERATIONS AND LIENS

A. Alterations.

Subsequent to the completion of any Landlord’s Work pursuant

to Section 2, Tenant shall not attach any fixtures, equipment or

other items to the Premises, or paint or make any other additions,

changes, alterations, repairs or improvements (collectively

hereinafter “alterations”) to the Premises, Building or

Property without Landlord’s prior written consent, which with

respect to alterations to the Premises will not be unreasonably

withheld so long as Tenant is not then, nor has been, in default of

this Lease (beyond any applicable cure period). If Landlord

consents to any alteration, Landlord may post notices of

nonresponsibility in accordance with Law. Any alterations so made

shall remain on and be surrendered with the Premises upon

expiration or earlier termination of this Lease, except that

Landlord may, within thirty (30) days before or thirty (30) days

after expiration or earlier termination hereof elect to require

Tenant to remove any or all alterations at Tenant’s sole

costs and expense. At the time Tenant submits plans for requested

alterations to Landlord for Landlord’s approval, Tenant may

request Landlord to identify which alterations Landlord may require

Tenant to remove at the termination of or expiration of this Lease,

and Landlord shall make such identification simultaneous with its

approval (if any) of the alterations. If Landlord elects to require

removal of alterations, then at its own and sole cost Tenant shall

restore the Premises to the condition designated by Landlord in its

election, before the last day of the term or within thirty (30)

days after notice of its election is given, whichever is

later.

B. Performance.

In the event Landlord consents in writing to Tenant’s

requested alteration of the Premises, Tenant shall only contract

with a contractor approved by Landlord for the construction of such

alterations, shall secure all appropriate governmental approvals

and permits and shall complete such alterations with due diligence,

in a neat, clean, good and workmanlike manner and in strict

compliance with the plans and specifications approved by Landlord.

All such construction shall be performed in a manner which shall

not interfere with the occupancy of the other tenants of the

Building. All cost, expenses and fees related to or arising from

construction of any alteration shall be paid by Tenant prior to

delinquency. There shall also be included within the cost of any

such alteration work (whether for initial tenant improvements or

for any subsequent alteration) a fee to Landlord for Tenant’s

use of Landlord’s personnel involved in the supervision,

coordination, inspection and the like pertaining to such work. Said

fee shall be ten percent (10%) of the total cost of the alteration

work (including costs of plans and permits), plus Landlord’s

out-of-pocket costs (if any), which shall be paid by Tenant within

ten (10) days after presentment by Landlord of an invoice therefor.

Landlord may impose additional reasonable conditions and rules

respecting the manner and times in which such alteration work may

be performed.

C. Liens.

Tenant shall pay all costs for alterations when due. Tenant shall

keep the Property, Building, Premises and this Lease free from any

mechanic’s, materialman’s, architect’s,

engineer’s or similar liens or encumbrances, and any claims

therefor, or stop or violation notices, in connection with any

alteration. Tenant shall remove any such claim, lien or

encumbrance, or stop or violation notices of record, by bond or

otherwise within ten (10) days after notice by Landlord. If Tenant

fails to do so, such failure shall constitute a default by Tenant,

and Landlord may, in addition to any other remedy, pay the amount

(or any portion thereof) or take such other action as Landlord

deems necessary to remove such claim, lien or encumbrance, or stop

or violation notices, without being responsible for investigating

the validity thereof. The amount so paid and costs incurred by

Landlord shall be deemed additional Rent under this Lease payable

upon demand, without limitation as to other remedies available to

Landlord. Landlord may, in its discretion, require Tenant to obtain

a lien and completion bond or some alternate form of security

satisfactory to Landlord in an amount sufficient to ensure the

lien-free completion of such alterations and naming Landlord as a

co-obligee. Nothing contained in this Lease shall authorize Tenant

to do any act which shall subject Landlord’s title to, or any

Lender’s interest in, the Building, Property or Premises to

any such claims, liens or encumbrances, or stop or violation

notices, whether claimed pursuant to statute or other Law or

express or implied contract.

D. Construction

Insurance. In addition to the requirements of Section 11

below, in the event that Tenant makes any alterations, prior to the

commencement of such alterations, Tenant shall provide Landlord

with evidence that Tenant or its general contractor, as

appropriate, carries “Builder’s All Risk”

insurance or its equivalent in an amount approved by Landlord

covering the construction of such alterations, and such other

insurance as Landlord may reasonably require, it being understood

and agreed that all of such alterations shall be insured by Tenant

pursuant to Section 10 of this Lease immediately upon completion

thereof.

SECTION

11: INSURANCE AND WAIVER OF SUBROGATION

A. Insurance.

During the term of this Lease, Tenant, at its sole cost and

expense, shall continuously maintain the following types of

insurance coverages: (i) All Risk or Causes of Loss - Special Form property

insurance, including fire and extended coverage, sprinkler leakage,

vandalism, malicious mischief, wind and flood coverage, covering

full replacement value of all of Tenant’s personal property,

trade fixtures and improvements and alterations in and to the

Premises, with coverages that also include “Business

Personal Property” and “Business Income Coverage”

covering at least one year of anticipated income; (ii)

both worker’s compensation

insurance to the applicable statutory limit, if any, and

employer’s liability insurance to the limit of $1,000,000 per

occurrence; (iii) commercial general liability insurance (occurrence

based) insuring Tenant against any liability arising out of its

use, occupancy or maintenance of the Premises or Building, or the

business operated by Tenant pursuant to the Lease, and providing

coverage for death, bodily injury and disease, property damage or

destruction (including loss of use), products and completed

operations liability, contractual liability which includes all of

Tenant’s indemnity obligations under this Lease (and

the certificate evidencing Tenant’s insurance coverage shall

state that the insurance includes the liability assumed by Tenant

under this Lease), fire legal

liability and advertising injury liability damage with a combined

single limit of no less than $5,000,000 (or in the alternative a primary policy combined

single limit of $2,000,000 with an Excess Limits (Umbrella) Policy

in the amount of no less than $3,000,000); and

(iv) Business Automobile Liability Insurance for Tenant owned

vehicles (only) in the amount of $1,000,000 combined single limit

(property damage and liability). The amount of any deductible or

self-insured retention for the coverages described in (i) and (iii)

shall not exceed Five Thousand Dollars ($5,000.00), and any

deductible or self-insurance provisions under any other insurance

policies required to be maintained by Tenant shall be subject to

Landlord’s prior written approval, such approval not to be

unreasonably withheld.

8

B. Additional

Requirements.

(i) All

insurance required to be carried by Tenant hereunder shall include

the following provisions: (a) shall name Landlord, Landlord's

property manager, and Landlord’s lender (if any) as

additional insureds; (b) shall release Landlord (and its

property manager and lender, if any) from any claims for damage to

business or to any person or the Premises, the Building and the

Property and to Tenant’s fixtures, personal property,

improvements and alterations in or on the Premises, caused by or

resulting from risks insured against under any insurance policy

carried by Tenant in force at the time of such damage;

(c) shall be issued by Insurance companies authorized to do

business in the State of Washington, with policyholder ratings not lower than

“A-” and financial ratings not lower than

“VII” in Best’s Insurance Guide (latest edition

in effect as of the date of this Lease and subsequently in effect

as of the date of renewal of the required policies);

(d) Shall be issued as (and separately endorsed as) a primary

and noncontributory policy as such policies apply to Landlord

(except for workers compensation); and (e) Shall contain an

endorsement requiring at least thirty (30) days prior written

notice of cancellation to Landlord and Landlord’s lender (if

any), before cancellation or change in coverage, scope or amount of

any policy. Tenant shall deliver certificates of such policies

together with evidence of payment of all current premiums to

Landlord within thirty (30) days of execution of this Lease;

provided, if such certificates do not on their face evidence such

terms, Tenant shall also provide full copies of such endorsements

or policies as necessary to evidence that all of the coverage

requirements of this Section 11 have been satisfied by Tenant. Any

certificate of insurance shall designate Tenant as the insured,

specify the Premises location, list Landlord (and its property

manager and lender, if any) as additional insureds (with the

additional insured endorsement attached thereto), and list Landlord

with Landlord’s current address as “Certificate

Holder.” If certificates are

supplied (rather than the policies), Tenant shall allow Landlord,

at all reasonable times, to inspect the policies of insurance

required herein. Tenant shall take all necessary steps to

renew all insurance at least thirty (30) days prior to such

insurance expiration dates and shall provide Landlord a copy of the

renewed certificate, prior to said policy’s expiration date.

If Tenant fails at any time to maintain the insurance required by

this Lease, and fails to cure such default within five (5) business

days of written notice from Landlord then, in addition to all other

remedies available under this Lease and applicable Law, Landlord

may purchase such insurance on Tenant’s behalf and the cost

of such insurance shall be Additional Rent due within ten (10) days

of written invoice from Landlord to Tenant.

(ii) It

is expressly understood and agreed that the coverages required by

this Section 11 represent Landlord’s minimum requirements and

such are not to be construed to void or limit Tenant’s

obligations contained in this Lease, including without limitation

Tenant’s indemnity obligations hereunder. Neither shall (a)

the insolvency, bankruptcy or failure of any insurance company

carrying Tenant, (b) the failure of any insurance company to pay

claims occurring nor (c) any exclusion from or insufficiency of

coverage be held to affect, negate or waive any of Tenant’s

indemnity obligations under this Lease or any other provision of

this Lease. Landlord reserves the right to require Tenant provide

evidence of any additional insurance as it reasonably deems

appropriate, as well as the right to require an increase in the

amounts of insurance or the insurance coverages as Landlord may

reasonably request from time to time, but not in excess of the

requirements of prudent landlords or lenders for similar tenants

occupying similar premises in the Puget Sound metropolitan area.

Tenant’s occupancy of the Premises without delivering the

certificates of insurance shall not constitute a waiver of

Tenant’s obligations to provide the required coverages. If

Tenant provides to Landlord a certificate that does not evidence

the coverages required herein, or that is faulty in any respect,

such shall not constitute a waiver of Tenant’s obligations to

provide the proper insurance

C. Waiver

of Subrogation. Landlord and Tenant release and relieve the

other, and waive the entire right of recovery for loss or damage to

property located within or constituting a part or all of the

Premises, the Building or the Property to the extent that the loss

or damage is actually covered (and claim amount recovered) by

commercial insurance carried by either party and in force at the

time of such loss or damage. This waiver applies whether or not the

loss is due to the negligent acts or omissions of Landlord or

Tenant, or their respective officers, directors, employees, agents,

contractors, or invitees. Each of Landlord and Tenant shall have

their respective property insurers endorse the applicable insurance

policies to reflect the foregoing waiver of claims, provided,

however, that the endorsement shall not be required if the

applicable policy of insurance permits the named insured to waive

rights of subrogation on a blanket basis, in which case the blanket

waiver shall be acceptable.

SECTION

12: CASUALTY DAMAGE

9

In the

event the Building or Premises shall be destroyed or rendered

untenantable, either wholly or in part, by fire or other casualty,

Landlord may, at its option, restore the Building or Premises to as

near their previous condition as is reasonably possible and in the

meantime the Rent shall be abated in the same proportion as the

untenantable portion of the Premises bears to the whole thereof,

provided, such

abatement (i) shall apply only to the extent the Premises are

untenantable for the purposes permitted under this Lease and not

used by Tenant as a result thereof, and (ii) shall not apply if

Tenant or any other occupant of the Premises or any of their

agents, employees, invitees, transferees or contractors caused the

damage. Unless Landlord, within sixty (60) days after the happening

of any such casualty, shall notify Tenant of its election to so

restore, this Lease shall thereupon terminate and end, provided, if in

Landlord’s estimation the Premises cannot be restored within

one hundred twenty (120) days following such destruction, Landlord

shall notify Tenant and Tenant may terminate this Lease (regardless

of Landlord’s intent to restore) by delivery of notice to

Landlord within thirty (30) days of Landlord’s notice. Such

restoration by Landlord shall not include replacement of furniture,

equipment or other items that do not become part of the Building or

any improvements to the Premises in excess of those provided for in

the allowance for building standard items. Tenant agrees that the

abatement of Rent as provided above shall be Tenant’s sole

and exclusive recourse in the event of such damage, and Tenant

waives any other rights Tenant may have under applicable Law to

perform repairs or terminate the Lease by reason of damage to the

Building or Premises.

SECTION

13: CONDEMNATION

If at

least fifty percent (50%) of the rentable area of the Premises

shall be taken by power of eminent domain or condemned by a

competent authority or by conveyance in lieu thereof for public or

quasi-public use (“Condemnation”), including any

temporary taking for a period of one year or longer, this Lease

shall terminate on the date possession for such use is so taken.

If: (i) less than fifty percent (50%) of the Premises is taken, but

the taking includes or affects a material portion of the Building

or Property, or the economical operation thereof, (ii) less than

fifty percent (50%) of the Premises are taken and in the reasonable

judgment of Landlord the remaining Premises are not usable for the

business of Tenant, or (iii) the taking is temporary but will be in

effect for more than thirty (30) days, then in either such event,

Landlord may elect to terminate this Lease upon at least thirty

(30) days’ prior notice to Tenant. The parties further agree

that: (a) if this Lease is terminated, all Rent shall be

apportioned as of the date of such termination or the date of such

taking, whichever shall first occur, (b) if the taking is

temporary, Rent shall not be abated for the period of the taking,

but Tenant may seek a condemnation award therefor (and the Term

shall not be extended thereby), and (c) if this Lease is not

terminated but any part of the Premises is permanently taken, the

Rent shall be proportionately abated based on the square footage of

the Premises so taken. Landlord shall be entitled to receive the

entire award or payment in connection with such Condemnation and

Tenant hereby assigns to Landlord any interest therein for the

value of Tenant’s unexpired leasehold estate or any other

claim and waives any right to participate therein, and Tenant shall

make no claim against Landlord for termination of the leasehold

interest or interference with Tenant’s business. Tenant,

however, shall have the right to claim damages from the condemning

authority for a temporary taking of the leasehold as described

above, for moving expenses and any taking of Tenant’s

personal property and for the interruption to Tenant’s

business, but only if such damages are awarded separately in the

eminent domain proceeding and not as part or in diminution of the

damages recovered by Landlord.

SECTION

14: ASSIGNMENT AND SUBLETTING

A. Consent

Required. Tenant shall not, without the prior written

consent of Landlord, assign this Lease or any interest therein, or

sublet the Premises or any part thereof, or permit the use of the

Premises by any party other than Tenant or otherwise transfer this

Lease (collectively “Transfer”). Such consent shall be

entirely discretionary with Landlord, except as otherwise provided

in this Section 14. Consent to one such Transfer shall not destroy

or waive this provision, and all subsequent Transfers shall

likewise be made only upon obtaining prior written consent of

Landlord. Subtenants or assignees shall become directly liable to

Landlord for all obligations of Tenant hereunder, without relieving

Tenant of any liability.

B. Transfers.

If Tenant is a corporation, then any Transfer of this Lease by

merger, consolidation or liquidation, or any change in the

ownership of, or power to vote, the majority of its outstanding

voting stock, shall constitute an assignment for the purpose of

this Section 14. If Tenant is a partnership or limited liability

company, any Transfer of this Lease by merger, consolidation,

liquidation or dissolution, or any change in the ownership of a

majority of the partnership or membership interests, shall

constitute an assignment for the purposes of this Section 14. An

assignment forbidden within the meaning of this Section includes

without limitation one or more sales or Transfers, by operation of

law or otherwise, or creation of new stock, by which an aggregate

of more than fifty percent (50%) of Tenant’s stock shall be

vested in a party or parties who are nonstockholders as of the date

hereof. This Section 14(B) shall not apply if Tenant’s stock

is listed on a recognized security exchange or if at least eighty

percent (80%) of its stock is owned by a corporation whose stock is

listed on a recognized security exchange.

10

C. Recapture.

If Tenant at any time desires to Transfer this Lease or any part

thereof, it shall first notify Landlord in writing of its desire to

do so, and offer Landlord the right to recapture, at the per square

foot rental for the space then applicable pursuant to this Lease or

the rental which Tenant proposed to obtain whichever is lower, for

all or any part of the Premises which Tenant desires to assign or

sublet. Tenant’s notice to Landlord shall specify (i) the

name and business of the proposed assignee or sublessee, (ii) the

amount and location of this space affected, (iii) the proposed

effective date and duration of the subletting or assignment, and

(iv) the proposed rental to be paid to Tenant by such sublessee or

assignee. Landlord, upon receipt of such notice, shall have the

option, to be exercised within sixty (60) days from the date of the

receipt of such notice, to require Tenant to execute an assignment

to Landlord of this Lease (if Tenant desires to assign this Lease)

or a sublease to Landlord of the Premises or such portion thereof

as Tenant desires to sublet with the right of Landlord to sublease

to others, or anyone designated by Landlord. If Landlord exercises

such option and such assignment or sublease is at the rental

specified in this Lease, Tenant shall be released of all further

liability hereunder, from and after the effective date of such

assignment or sublease, with respect to that portion of the

Premises included therein. If Landlord does not exercise such

option within such time, Tenant may thereafter assign this Lease or

sublet the premises involved, provided Landlord consents thereto,

but at a rental not less than offered to Landlord in the notice and

not later than ninety (90) days after delivery of the aforesaid

notice unless a further notice is given. In the event Landlord does

not exercise its right to terminate this Lease or to sublet a

portion of the Premises from Tenant and Landlord has granted its

written consent, Tenant may assign this Lease or sublet all or a

portion of the Premises in accordance with Landlord’s

consent. Any Rent accruing to Tenant as a result of such assignment

or sublease which is in excess or the Rent then being paid by

Tenant, or in excess of the pro rata share of Rent then being paid

by Tenant for the portion of the Premises being sublet, shall be

paid by Tenant to Landlord monthly as additional rent.

D. Costs.

Whether or not Landlord consents to a proposed Transfer (or

exercises its right to recapture), Tenant shall reimburse Landlord

on demand for any and all costs that may be incurred by Landlord in

connection with any proposed Transfer including, without

limitation, the cost of investigating the acceptability of the

proposed transferee and Landlord’s reasonable

attorneys’ fees incurred in connection with each proposed

Transfer.

E. Notice.

Any notice or request to Landlord with respect to a proposed

assignment or sublease shall contain the name of the proposed

assignee or subtenant (collectively “Transferee”), the

nature of the proposed Transferee’s business to be conducted

at the Premises, and the terms and provisions of the proposed

Transfer. Tenant shall also provide Landlord with a copy of the

proposed Transfer documents when available, and such financial and

other information with respect to the proposed Transferee and

Transfer that Landlord may reasonably require.

F. Consent.

Notwithstanding the foregoing, in the event of a proposed Transfer,

if Landlord does not exercise its option under Section 14(C), then

Landlord will not unreasonably withhold its consent thereto if (a)

Tenant is not then, nor has been, in default of this Lease (beyond

any applicable cure period), (b) the proposed Transferee will

continuously occupy and use the Premises for the term of the

Transfer, (c) the use by the proposed Transferee will be the same

as Tenant’s use of the Premises, (d) the proposed Transferee

is reputable and of sound financial condition, (e) the Transfer

will not directly or indirectly cause Landlord to be in breach of

any contractual obligation, and (f) the proposed Transferee is not

an existing tenant or subtenant of any other premises located on

the Property. In all other cases, Landlord may withhold consent in

its sole discretion.

G. Terms;

Transfer Premium. Any option(s) granted to Tenant in this

Lease or any option(s) granted to Tenant in any amendments to this

Lease, to the extent that said option(s) have not been exercised,

shall terminate and be voided in the event this Lease is assigned,

or any part of the Premises are sublet, or Tenant’s interest

in the Premises are otherwise Transferred, unless otherwise agreed

to by Lanadlord. If Landlord consents to a Transfer, as a condition

thereto which the parties hereby agree is reasonable, Tenant shall

pay to Landlord fifty percent (50%) of any “Transfer

Premium,” as that term is defined in this Section 14(G),

received by Tenant from such Transferee. “Transfer

Premium” shall

mean all rent, additional rent or other consideration payable by

such Transferee in connection with the Transfer in excess of the

Rent and Additional Rent payable by Tenant under this Lease during

the term of the Transfer on a per rentable square foot basis if

less than all of the Premises is transferred, after deducting the

reasonable expenses incurred by Tenant for (i) any changes,

alterations and improvements to the Premises in connection with the

Transfer, (ii) any free base rent or other economic concessions

reasonably provided to the Transferee, (iii) any brokerage

commissions in connection with the Transfer, and (iv) actual,

reasonable attorneys’ fees incurred by Tenant in connection

with the Transfer. “Transfer Premium” shall also include, but

not be limited to, key

money, bonus money or other cash consideration paid by Transferee

to Tenant in connection with such Transfer, and any payment in

excess of fair market value for services rendered by Tenant to

Transferee or for assets, fixtures, inventory, equipment, or

furniture transferred by Tenant to Transferee in connection with

such Transfer. The determination of the amount of Landlord’s

applicable share of the Transfer Premium shall be made on a monthly

basis as rent or other consideration is received by Tenant under

the Transfer.

SECTION

15: PERSONAL PROPERTY, RENT AND OTHER TAXES

Tenant

shall pay prior to delinquency all taxes, charges or other

governmental impositions assessed against, levied upon or otherwise

imposed upon or with respect to all fixtures, furnishings, personal

property, systems and equipment located in or exclusively serving

the Premises, and any improvements made to the Premises under or

pursuant to the provisions of this Lease. Whenever possible, Tenant

shall cause all such items to be assessed and billed separately

from the other property of Landlord. In the event any such items

shall be assessed and billed with the other property of Landlord,

Tenant shall pay Landlord its share of such taxes, charges or other

governmental impositions within ten (10) days after Landlord

delivers a statement and a copy of the assessment or other

documentation showing the amount of impositions applicable to

Tenant’s property. Tenant shall pay any rent tax, sales tax,

service tax, transfer tax, value added tax, or any other applicable

tax on the Rent, utilities or services herein, the privilege of

renting, using or occupying the Premises, or collecting Rent

therefrom, or otherwise respecting this Lease or any other document

entered in connection herewith.

11

SECTION

16: TENANT’S DEFAULT; LANDLORD’S

REMEDIES

A. Default.

The occurrence of any one or more of the following events shall

constitute a “Default” by Tenant and shall give rise to

Landlord’s remedies set forth in Section 16(B) below: (i)

failure to make when due any payment of Rent, provided, however, that Tenant shall

not be in default solely due to such failure so long as (a) no more

than one (1) such failure occurs during any calendar year, and (b)

any such failure is cured within three (3) business days after

notice from Landlord; (ii) failure to observe or perform any term

or condition of this Lease other than the payment of Rent (or the

other matters expressly described herein), unless such failure is

cured within any period of time following notice expressly provided

with respect thereto in other Sections hereof, or otherwise within

a reasonable time, but in no event more than thirty (30) days

following notice from Landlord (provided, if the nature of

Tenant’s failure is such that more time is reasonably

required in order to cure, Tenant shall not be in Default if Tenant

commences to cure promptly within such period and thereafter

diligently pursues its completion); (iii) failure to cure

immediately upon notice thereof any condition which is hazardous,

interferes with another tenant or the operation or leasing of the

Property, or may cause the imposition of a fine, penalty or other

remedy on Landlord or its agents or affiliates; (iv) abandonment

and vacation of the Premises (failure to occupy and operate the

Premises for ten (10) consecutive days while in monetary default

under this Lease shall conclusively be deemed an abandonment and

vacation); or (v) Tenant, or any guarantor of this Lease

(“Guarantor”), filing by or for reorganization or

arrangement under any Law relating to bankruptcy or insolvency

(unless, in the case of a petition filed against Tenant or such

Guarantor, the same is dismissed within thirty (30) days); (b)

Tenant’s or any Guarantor’s insolvency or failure, or

admission of an inability, to pay debts as they mature, or (c) a

violation by Tenant or any affiliate of Tenant under any other

lease or agreement with Landlord or any affiliate thereof which is

not cured within the time permitted for cure thereunder.

Additionally, if Tenant violates the same term or condition of this

Lease on two (2) occasions during any twelve (12) month period,

Landlord shall have the right to exercise all remedies for any

violations of the same term or condition during the next twelve

(12) months without providing further notice or an opportunity to

cure. The notice and cure periods provided herein are intended to

satisfy any and all notice requirements imposed by Law on Landlord

and are in lieu of, and not in addition to, any notice and cure

periods provided by Law; provided, Landlord may elect to

comply with such notice and cure periods provided by Law. In the

event of Tenant’s default, and in addition to any other